If you’re a driver or car owner, chances are you’ve wondered, “What cars are most expensive to insure?” The answer isn’t as simple as you might think. Insurance rates are influenced by a variety of factors, from the type of vehicle you drive to your driving history and even your location. For young drivers and seasoned car owners alike, understanding these factors can help you make smarter decisions and potentially save hundreds—or even thousands—of dollars in annual premiums.

This article explores the cars that are typically the most expensive to insure, the factors impacting insurance costs, and actionable strategies to keep those costs in check.

Factors Affecting Car Insurance Costs

Table of Contents

Vehicle Type

One of the largest factors affecting car insurance rates is your vehicle type. Insurers consider the make, model, and year of your car to calculate premiums. Luxury cars, sports cars, and vehicles with high repair costs often come with higher insurance rates.

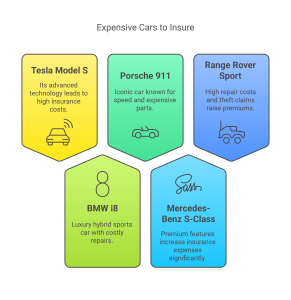

Here’s a list of some of the most expensive cars to insure:

Expensive Cars to Insure

- Tesla Model S: Its cutting-edge technology and high repair costs make it pricier to insure.

- BMW i8: As a luxury hybrid sports car, its parts and repair requirements significantly raise insurance premiums.

- Porsche 911: The iconic look, speed, and cost of parts make this a top-tier vehicle for high insurance rates.

- Mercedes-Benz S-Class: The premium features and complex engineering drive up costs.

- Range Rover Sport: Its repair costs and popularity in theft claims contribute to higher premiums.

Why These Cars Cost More

- High Repair Costs: Luxury and sports cars often require specialized parts and expertise, which are expensive to source.

- Likelihood of Theft: High-value cars are more likely targets for theft, increasing the risk for insurers.

- Accidents and Claims Data: Sports cars are statistically more involved in high-speed accidents, raising their risk profile.

Safety Features

Contrary to vehicle type, safety features like automatic braking, lane assistance, and advanced airbag systems can reduce insurance costs. Cars equipped with these features are considered less likely to get into accidents, lowering the insurer’s risk.

Recommendations for Car Buyers

If you’re in the market for a new car and want to save on insurance:

- Choose vehicles with high safety ratings from agencies like the IIHS.

- Look for models with comprehensive safety features such as collision sensors and adaptive cruise control.

- Compare vehicles for safety and insurance costs before making a decision.

Driver Profile

Insurers heavily factor in your profile, including:

- Age: Younger drivers under 25 often pay higher premiums due to their limited driving experience.

- Driving Record: A clean driving record can significantly lower your premiums while speeding tickets or accidents will increase costs.

- Location: Urban areas with higher rates of accidents and theft often result in higher insurance costs compared to rural zones.

Tips for Young or High-Risk Drivers

- Enroll in telematics insurance programs that monitor safe driving habits to earn lower premiums.

- Look for discounts offered to students or first-time drivers.

- Avoid high-risk behaviors like speeding and distracted driving to maintain a clean record.

Insurance Policy Features

The type of coverage you choose impacts your overall insurance costs. Standard car insurance policies typically include:

- Liability Coverage (required in most states): Covers costs related to damage or injury caused to others.

- Collision Coverage: Pays for damage to your car in an accident.

- Comprehensive Coverage: Covers damage from non-collision incidents like natural disasters or theft.

Balancing Coverage and Costs

While choosing minimal coverage reduces upfront premiums, consider the risks. An accident without collision or comprehensive coverage could lead to hefty out-of-pocket expenses. A middle-ground approach may be to opt for a higher deductible, which lowers monthly premiums while keeping essential coverage intact.

Strategies to Lower Insurance Costs

Thankfully, there are effective ways to reduce your car insurance premiums without sacrificing critical coverage.

1. Comparison Shopping

Not all insurance providers calculate premiums the same way. Rates can vary significantly from one insurer to another, so comparing quotes is crucial.

Use Online Tools

Leverage online insurance comparison websites to get multiple quotes in minutes. Tools such as Progressive’s Rate Comparison or The Zebra are great starting points.

2. Take a Defensive Driving Course

Some insurers offer discounts to drivers who complete a certified defensive driving course. These courses demonstrate your commitment to road safety, which insurers value.

Where to Find Courses

- Local DMV offices

- Accredited driving schools

- Online platforms like iDriveSafely

3. Maintain a Good Credit Score

Did you know most insurers take your credit score into account when determining your premium? A strong credit score suggests you’re financially responsible, which can translate to better rates.

Tips for Improving Credit Health

- Pay your bills on time.

- Keep your credit card balances low.

- Check your credit report annually for errors.

4. Regular Vehicle Maintenance

Keeping your car in good condition reduces the likelihood of mechanical failures that could lead to accidents—or claims. Maintenance can also prevent your car from depreciating at a rapid rate, which helps with lower premiums.

Key Areas to Maintain

- Brakes and tires

- Engine health

- Lights and windshield wipers

Why It’s Worth Understanding Insurance Costs

Car insurance costs can be a significant part of your annual budget, so understanding what drives premium rates is essential. By knowing what factors are in play—from the type of car you drive to your credit score—you can actively take steps to minimize costs while keeping robust coverage.

Taking a little extra time to research and plan your insurance strategy means you’ll have more financial freedom for things that bring joy, whether it’s a weekend drive in the countryside or saving up for your next dream car.

Your Turn!

Have you found effective ways to save on car insurance? Or have you recently purchased a car and learned about unexpected insurance costs? Share your tips and experiences in the comments below or join the discussion on social media! Together, we can help more drivers make smarter, more informed decisions.