Health insurance—essential yet complex—is often a major financial commitment for individuals and businesses alike. But have you ever wondered what makes some health insurance plans extremely expensive? Understanding the intricacies of pricing can guide smarter decisions for high-income earners, health-conscious individuals, or small business owners seeking comprehensive coverage.

Here, we’ll explore why some health insurance plans come with jaw-dropping premiums, define the components that affect costs, and share insights to help you make informed choices.

Understanding Health Insurance Costs

Table of Contents

Health insurance isn’t a one-size-fits-all investment. It comes with several moving parts that contribute to its overall price. Here are three key cost factors you need to know about:

Premiums

A premium is your monthly payment to your insurer to keep your coverage active. High premiums often accompany plans loaded with comprehensive coverage, expanded networks, or lower out-of-pocket costs for members.

Deductibles

This refers to the amount you pay out of pocket before your insurance kicks in. Plans with higher premiums tend to have lower deductibles, making them appealing to anyone who frequently uses healthcare services.

Co-Pays

Co-pays are a fixed amount you pay each time you access a specific service, such as visiting a doctor or picking up a prescription. Depending on the benefits, co-pays may be minimal or even non-existent for expensive plans.

Understanding these three cost components is the first step toward recognizing why certain health insurance policies come with such hefty price tags.

What Makes Health Insurance Expensive?

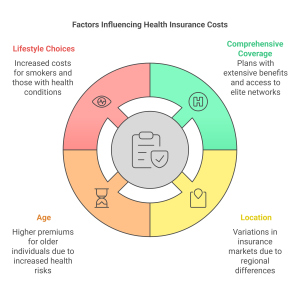

Factors Affecting Health Insurance Costs

- Comprehensive Coverage: Plans offering access to elite hospital networks, specialists, or treatments covering rare conditions come at a higher cost.

- Location: Insurance markets vary by state or region due to differing regulations, healthcare access, and average costs of services.

- Age: Older individuals generally face higher premiums as they are statistically more likely to require healthcare services.

- Lifestyle Choices: Smoking, obesity, or pre-existing conditions could increase premium rates significantly.

The Role of Health in Determining Premiums

The healthier you are, the less your insurer assumes you’ll need covered services. Consequently, individuals or businesses offering employee-sponsored coverage can cut costs by promoting wellness programs to employees. Still, even for health-conscious individuals, premium plans designed to anticipate any healthcare need will remain on the expensive side.

Most Expensive Health Insurance Plans

When it comes to high-end plans, the sky’s the limit for price and perks. Here’s how some of the world’s most expensive health insurance options compare.

Comparison of High-End Plans

- Cigna Global Plan

- Cost: Starting at $30,000+ annually

- Features: 24/7 access to personalized health services, including elite provider networks and flexible premium options for expatriates.

- Cost: Approximately $25,000 annually

- Features: Extensive international coverage, direct billing with hospitals worldwide, and access to mental health or wellness specialists.

- Aetna International Exclusive Plan

- Cost: Around $20,000 annually

- Features: Coverage for routine exams, private rooms in hospitals, and even fertility treatments in certain tiers.

Features and Benefits of Expensive Health Insurance

What sets these plans apart isn’t just high premiums but also exclusive benefits, including access to VIP medical care, global coverage, tailored health assessments, and even concierge services to help plan treatments. For individuals unwilling to compromise on healthcare quality, these plans promise peace of mind alongside access to top-tier facilities and specialists.

How to Save on Health Insurance Costs

While premium health insurance plans offer unmatched benefits, not everyone can justify such investments. Here are strategies to save without sacrificing quality.

Tips for Choosing Affordable Plans

- Evaluate Your Needs: Work out whether you need in-network flexibility or specialized treatment options before opting for a high-end plan.

- Choose Tiered Plans: Go for silver or bronze-tier plans instead of unlimited options. These may limit extras but still provide comprehensive coverage.

- Shop Around: Compare multiple insurers to see which one offers the best value for your needs.

Utilizing Health Savings Accounts (HSAs)

Health Savings Accounts can be a game-changer for managing healthcare expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses remain tax-free. They pair best with high-deductible health plans (HDHPs).

The Future of Health Insurance Costs

The healthcare sector continues to evolve in ways that influence insurance pricing. Staying proactive about upcoming trends can help individuals and businesses better prepare.

Trends in Premiums and Coverage

One major trend expected in the coming years is personalized insurance. AI and big data allow insurers to offer policies tailored to individual needs and risks, potentially reducing costs for some while increasing them for others. Another is value-based care, where insurers reward providers for delivering quality outcomes instead of high service volumes.

Innovations in the Health Insurance Industry

- Telemedicine coverage is expanding to include remote consultations for mental health, chronic illness management, and more, providing cost-effective treatment options.

- Wearable Technology like fitness trackers is helping insurers promote healthier behaviors, occasionally rewarding members with lower premiums for meeting fitness milestones.

Ensuring Quality Healthcare Access at a Reasonable Cost

High-quality insurance doesn’t have to break the bank—for individuals or businesses. By understanding the mechanics of insurance costs and leveraging tools like HSAs, you can save while ensuring access to top-tier healthcare solutions.

If you’re considering transitioning to a premium health insurance plan, remember to evaluate not just the cost, but also how the coverage aligns with your long-term health goals. Be informed, be strategic, and make the right choice for your needs.

Looking for more insights into choosing the right health insurance plan? Access [insert resource or tool link] for detailed comparisons and advice.