Every car owner’s dream vehicle comes with its perks – top-tier performance, luxury comfort, and unmatched design. But behind the dream often lies a reality check in the form of insurance premiums. Knowing which vehicles are the most expensive to insure can save you from financial surprises and help you plan your purchase or adjust your budget.

This blog will cover what drives high insurance rates, reveal the top 10 most expensive vehicles to insure, and provide insights into why these vehicles cost more to cover. We’ll also explore strategies to lower premiums and share real-life examples to help you make informed decisions.

Understanding Insurance Rates

Table of Contents

Insurance premiums are determined by various factors, and understanding these can provide clarity on why certain vehicles are expensive to insure.

Key Factors Influencing Insurance Premiums

- Vehicle’s Value

Expensive cars come with costly parts and repair bills. Insurers account for the replacement value of the car when determining premiums.

- Performance Capabilities

Sports cars and performance vehicles tend to have higher speeds, increasing the likelihood of accidents or claims.

- Repair and Maintenance Costs

High-end luxury vehicles often require specialized parts and services, further driving up premiums.

- Safety Features

Cars with advanced safety features may see reduced premiums. However, luxury vehicles with cutting-edge technology can offset this benefit due to costly repairs for such components.

- Theft Rates

Some vehicles, especially luxury or high-demand cars, are frequent targets for theft, resulting in elevated premiums.

- Driver Profile & Use Case

Insurers also look at your driving record, age, and how the vehicle is being used (personal vs. commercial purposes).

The Top 10 Most Expensive Vehicles to Insure

Here’s a look at the vehicles that typically top the charts for insurance costs. These cars, while prestigious, come with a hefty price tag for coverage.

1. Tesla Model S Plaid ($4,800 annual premium)

With its unmatched acceleration and cutting-edge tech, the Model S Plaid combines performance and complexity, which drives up repair costs and insurance rates.

2. Porsche Taycan Turbo S ($4,570 annual premium)

A luxurious electric sports car with thrilling speed, the Taycan Turbo S’s premium components and performance make it a high-risk (and costly) vehicle to insure.

3. BMW M8 Competition ($4,400 annual premium)

This high-performance coupe is built for speed, but its powerful engine and intricate technology make it expensive to repair, contributing to higher premiums.

4. Audi R8 V10 Performance ($4,370 annual premium)

An iconic supercar with top-tier engineering, the R8 is prized for speed but equally notorious for steep repair and replacement costs.

5. Mercedes-Benz AMG GT ($4,200 annual premium)

The epitome of luxury and performance, the AMG GT attracts high premiums due to its intricate components and repair demands.

6. Range Rover Sport SVR ($4,050 annual premium)

Luxury SUVs like the Range Rover Sport are loaded with high-performance parts, making them costlier to fix after an accident.

7. Lamborghini Urus ($4,000 annual premium)

A luxury SUV with sportscar performance, the Urus combines rarity, value, and high repair costs to claim a spot on this list.

8. Bentley Continental GT ($3,900 annual premium)

This grand tourer provides unparalleled luxury, but replacement parts and service require specialists, upping the insurance costs.

9. Chevrolet Corvette Stingray ($3,850 annual premium)

An American icon, the Corvette Stingray’s high performance and demand push up both its premium and theft-related costs.

10. Maserati Ghibli ($3,800 annual premium)

This Italian sedan delivers elegance and speed but comes with above-average maintenance costs, leading to expensive insurance.

Insights from Insurers

Why are these vehicles so pricey to insure? We spoke with insurance experts to find out.

- High Repair Costs

“The more bespoke parts a car has, the more specialists are required for repairs, which drives up costs,” notes insurance broker Alex Markham.

- Limited Safety Data

“New luxury models haven’t been on the road long enough for insurers to build safety statistics, which can lead to cautionary pricing,” explains Markham.

- High-Speed Risks

Performance vehicles are designed for speed and agility but tend to see more accident-related claims, resulting in higher premiums.

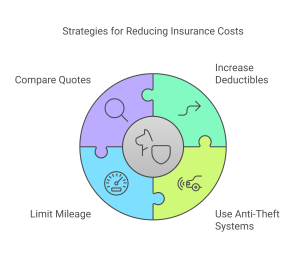

Tips to Mitigate Insurance Costs

- Increase Deductibles: Opt for higher deductibles to lower your monthly premiums.

- Use Anti-Theft Systems: Many insurers offer discounts for alarms or GPS trackers.

- Limit Mileage: Some insurers reduce costs for vehicles driven less frequently.

- Compare Quotes: Shop around to find the best rates for your specific vehicle.

Alternatives and Considerations

If high insurance premiums are a deal-breaker, consider alternative vehicles that balance luxury and cost. Cars like the Acura MDX or Lexus RX maintain a premium feel without breaking the bank on insurance.

Additionally, buying a used version of a luxury car can lower its value and, by extension, reduce premiums.

Real-World Case Study

Caroline’s Porsche Panamera Saga

Caroline, a consultant from Miami, fulfilled her dream of buying a Porsche Panamera. However, she was hit with a $4,400 annual insurance fee and quickly realized it wasn’t sustainable. After consulting her insurance provider, she installed advanced anti-theft systems, completed a defensive driving course, and bundled the car policy with her home insurance. These changes lowered her premiums by 20%, proving it’s possible to enjoy a luxury vehicle without financial strain.

Make an Informed Decision

Luxury and performance cars are undeniably appealing, but the cost of insurance shouldn’t be overlooked. Understanding what drives premium costs and exploring measures to reduce them can help you enjoy your dream car without unnecessary financial burden.

Are you weighing the pros and cons of insuring an expensive vehicle? Share this post with someone else who’s in the same boat, or contact an insurance expert for a tailored plan.