The world of home financing is evolving, and at the forefront of this transformation is the newly combined power of Myloancare Newrez. Two trusted names in the mortgage industry have joined forces to deliver enhanced services, innovative technology, and unmatched support for homeowners and buyers alike. Whether you’re navigating the complexities of mortgage refinancing or purchasing your first home, this merger could be a game-changer.

This blog dives into what the Myloancare Newrez merger means for you, the homeowner or buyer. From the impact on the mortgage industry to practical advice for leveraging these advancements, we’ve got everything covered to empower you on your financial path.

The Myloancare Newrez Merger—A New Standard in Home Loan Solutions

Table of Contents

Myloancare and Newrez have long stood out as trusted leaders in the mortgage and home loan space. Myloancare is widely recognized for its dedication to simplified mortgage servicing and customer satisfaction. Meanwhile, Newrez is renowned for its innovative financial tools and customizable loan products.

Together, these two financial giants are reshaping the home loan solutions landscape. By combining their strengths, they aim to redefine customer experiences with better service, cutting-edge technology, and tailored loan options to suit every financial need.

The Impact on the Mortgage and Refinancing Industry

The merger of Myloancare and Newrez creates a powerhouse of resources that has a ripple effect across the mortgage industry. But what does it mean for the average homeowner or buyer?

1. A Focus on Personalization

Both companies have consistently championed a customer-centric approach. The merged entity is doubling down on personalization, ensuring customers get mortgage and refinancing solutions that align perfectly with their financial goals.

2. Improved Access to Innovative Technology

Innovation has always been at the heart of Newrez, and this merger amplifies its reach. Expect smarter tools for pre-qualification, real-time mortgage tracking, and even enhanced AI-driven refinancing calculators—all designed to simplify decision-making.

3. Competitive Offers

The combined resources of Myloancare Newrez create economies of scale that can translate into better rates, reduced fees, and more flexible terms for customers. This is good news for both first-time homebuyers and long-time homeowners eyeing refinancing options.

Benefits for Customers

What’s in it for the customers? That’s the big question—and there’s a lot to get excited about.

Streamlined Mortgage Process

Say goodbye to paperwork headaches and delays. The new Myloancare Newrez ecosystem promises a hassle-free application and approval process, thanks to improved backend systems and digital solutions.

Tailored Loan Options

Whether you’re refinancing to secure a lower interest rate or looking for a first loan with flexible terms, this merger expands the variety of loan products at your disposal. It’s mortgage solutions designed specifically for you.

Expert Guidance Every Step of the Way

Navigating mortgages can be confusing, but Myloancare Newrez is committed to offering top-tier support. From live chat options to dedicated loan advisors, help is always just a call or click away.

Tasting Tech-Driven Innovation

Access AI-powered tools to determine the best refinancing or home loan strategy. These insights can help you save thousands over the life of your loan.

What to Expect Going Forward

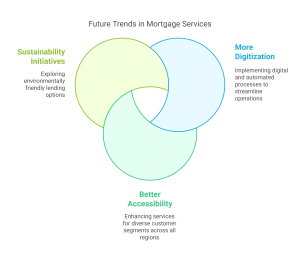

The Myloancare Newrez merger is just the beginning. It signals exciting trends for the mortgage refinancing and home loan industry:

- More Digitization: Expect more digital and automated processes to simplify the mortgage experience.

- Better Accessibility: Look forward to enhanced services for diverse customer segments, regardless of income level or geography.

- Sustainability Initiatives: Given the growing importance of ESG (Environmental, Social, and Governance) considerations, it’s likely the company will explore greener lending options in the future.

For homeowners and buyers, this means more choices, better tools, and a smoother ride in achieving homeownership dreams.

Practical Advice for Homeowners and Buyers

How can you make the most of these developments? Here’s some actionable advice:

1. Use Refinancing to Your Advantage

With competitive rates and AI-driven calculators, now is a great time to explore saving money through refinancing. Even a small reduction in interest rates could save you thousands.

2. Discover Tailored Loan Options

Talk to a Myloancare Newrez advisor about customized loan plans that fit your specific circumstances. Whether you’re self-employed or working with a tight budget, options are available.

3. Leverage the Technology

Dive into tools and apps provided by the new platform. Use them to explore pre-qualification processes, track refinancing progress, or compare interest rates in real time.

4. Learn, Learn, Learn

Stay informed about market trends! Knowing when to lock in interest rates or leverage equity can greatly affect your financial outcomes.

A Bright Future for Homeownership Solutions

The Myloancare Newrez merger isn’t just a business strategy—it’s a signal of exciting changes within the home loan and refinancing industry. For homeowners and buyers, this collaboration means more accessible solutions, smarter tools, and enhanced customer experiences.

If you’re considering your next steps in purchasing a home or refinancing your mortgage, now is the time to explore what this dynamic duo offers. Leap, use their tools, talk to their experts, and put your financial goals into action!