Car insurance is a necessity, but did you know the cost of your premiums can vary drastically depending on where you live? Some drivers are paying hundreds – even thousands – more per year simply because of their state’s insurance climate.

But why does car insurance cost so much in certain areas, and what can you do to save money if you reside in one of these states? This guide breaks down the top 5 most expensive states for car insurance in the U.S., dives into the reasons behind the high costs, and offers expert tips to bring those premiums down.

Whether you’re a car owner, a financial planner, or just curious about the factors impacting insurance rates, this blog has you covered.

Why Do Car Insurance Rates Vary by State?

Table of Contents

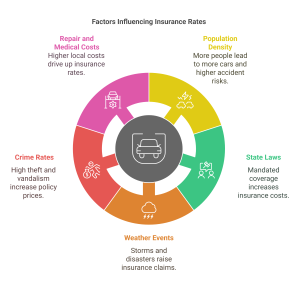

If you’ve wondered why your car insurance seems higher than your friends in another state, you’re not alone. Insurance premiums are impacted by several state-specific factors:

- Population density – More people means more cars, leading to higher chances of accidents.

- State laws – Some states mandate extensive coverage or additional protections that drive up costs.

- Weather and natural disasters – Storms, floods, and hurricanes increase claims.

- Crime rates – High vehicle theft and vandalism rates lead to pricier insurance policies.

- Costs of medical and vehicle repairs – States with higher healthcare and repair costs see increased insurance rates to offset these expenses.

With these variations in mind, it’s easy to understand why some states are notably expensive when it comes to car insurance. Now, let’s take a closer look at the top five.

The Top 5 Most Expensive States for Car Insurance

Here are the U.S. states with the highest average car insurance premiums, according to recent data:

- Louisiana – $2,839 per year

- Florida – $2,762 per year

- Michigan – $2,345 per year

- New York – $2,321 per year

- California – $2,115 per year

By contrast, states like North Carolina and Vermont offer some of the cheapest car insurance rates, averaging under $1,000 annually.

Why Are Car Insurance Costs High in These States?

Each of these top five states has unique factors contributing to its high premiums. Here’s a closer look:

1. Louisiana

Factors Driving Costs:

- Litigation Rates: Louisiana sees some of the nation’s highest rates of lawsuits involving car accidents, which raises insurance costs as companies pay hefty legal fees and settlements.

- Severe Weather: With frequent hurricanes and flooding, car damage and claims are common.

Quick Tip: Increase your deductible to save a few hundred dollars yearly, but only if you can afford it during emergencies.

2. Florida

Factors Driving Costs:

- No-Fault Insurance Laws: Florida drivers must carry personal injury protection (PIP), which inflates costs.

- Fraudulent Claims: Florida also struggles with high rates of insurance fraud, driving total premiums upward.

Quick Tip: Compare rates from multiple insurers regularly; Florida’s competitive market yields potential savings.

3. Michigan

Factors Driving Costs:

- Unlimited Medical Benefits: Michigan historically required unlimited medical coverage for car accidents, adding significant expenses. Reforms have eased this slightly, but premiums remain steep.

- Snowy Weather: Icy roads lead to numerous accidents each winter.

Quick Tip: Consider opting for Michigan’s “reduced PIP” option if your health insurance already covers extensive accident-related costs.

4. New York

Factors Driving Costs:

- Population Density: With millions of residents and countless vehicles, New York drivers face crowded roads and higher accident risks.

- Theft Rates: Luxury car theft rates are higher in major metro areas like NYC.

Quick Tip: Bundle your car insurance with other policies, like renters or homeowners insurance, for a loyalty discount.

5. California

Factors Driving Costs:

- Wildfires and Natural Disasters: California’s climate increases the likelihood of damage claims.

- High Cost of Living: Expensive medical care and vehicle repairs mean insurers pay more for claims.

Quick Tip: Drive fewer miles and apply for low-mileage discounts if you can work remotely or carpool.

Comparing the Most and Least Expensive States

To put things into perspective, here’s how the average premiums stack up between costly and affordable states:

|

State |

Average Annual Premium |

|---|---|

|

Louisiana |

$2,839 |

|

North Carolina |

$883 |

This massive discrepancy shows just how much location impacts car insurance. If you’re relocating to a lower-cost state, it might feel like an unexpected financial win.

How to Lower Your Car Insurance Costs Anywhere

Whether you live in Louisiana or North Carolina, there are ways to lower your insurance premiums. Use these strategies to save money, even in the most expensive states:

- Shop Around: Compare quotes from multiple providers. Rates can vary by hundreds of dollars for the same coverage.

- Bundle Policies: Combine your car insurance with home or renters insurance for discounts.

- Increase Your Deductible: A higher deductible lowers your premium but increases out-of-pocket costs during claims—ensure this matches your budget.

- Maintain a Clean Driving Record: Avoid tickets and accidents to benefit from “good driver” discounts.

- Utilize Discounts: Look for savings like low-mileage rates, safe driver programs, or loyalty rewards.

- Choose the Right Vehicle: Cars with advanced safety features and low theft rates often come with lower premiums.

- Drive Safely to Maintain Your Record.

For state-specific strategies in the five costliest states:

- Louisiana residents can focus on raising deductibles and avoiding claims to sidestep high litigation costs.

- Californians can benefit from low-mileage discounts, especially given the state’s growing remote workforce.

Stay Prepared and Save on Insurance Costs

Understanding the factors influencing car insurance premiums will empower your financial decisions. Whether you’re trying to cut costs or plan for future expenses, location-specific insights are key to making the most of your budget.

Are you spending too much on car insurance? Keep learning and saving by subscribing to our blog for more personal finance tips. Share this post with other drivers looking to save on insurance today!