Car insurance is essential for safeguarding your financial well-being in the event of accidents, theft, or natural disasters. However, as millions of drivers across the U.S. have realized, car insurance rates can vary dramatically depending on where you live. For many, these costs can feel like a significant burden on their wallets, particularly in states with notoriously high premiums.

This post explores the most expensive car insurance states, why their rates are so high, and what you can do to cut back on car insurance expenses—even if you call one of these costly states home. We’ll also take a look at how the future of car insurance might reshape the costs drivers face.

Understanding the Factors Behind Car Insurance Rates

Table of Contents

Not all car insurance is created equal, and understanding the factors that influence rates is crucial. Insurers calculate premiums using a mix of personal and location-based factors, including:

- Driving history: A history of accidents or traffic violations can lead to higher premiums.

- Vehicle type and usage: Luxury vehicles or cars with higher repair costs often have higher insurance rates.

- Population density: Highly populated areas typically see more accidents, thefts, and vandalism, leading to higher premiums.

- State laws and regulations: Insurance requirements set by states can significantly impact premium costs.

- Weather and natural disasters: Areas prone to hurricanes, floods, hail, or heavy snow may see steeper rates.

- Healthcare costs: Higher medical expenses in a region can raise liability-related insurance costs.

Why Do Rates Vary Across States?

Every state has unique laws, demographics, and risk factors, all of which can influence car insurance costs. For instance, while some states require only minimal liability coverage, others mandate higher levels of protection, which increases premiums. Additionally, states with dense urban centers or extreme weather events often see higher claims, which insurers factor into their pricing models.

Top 5 Most Expensive Car Insurance States

When it comes to the most expensive car insurance states, a few consistently lead the pack due to factors like population density, traffic congestion, and state-specific laws. Below, we break down the top five states with the highest premiums and what makes them so costly.

1. Michigan

Average annual premium: $2,611

Why it’s expensive: Michigan holds a notorious reputation for expensive car insurance due to its no-fault insurance system, which requires unlimited lifetime medical benefits for auto accident victims. While recent reforms have aimed to reduce these costs, premiums remain some of the highest in the nation.

2. Florida

Average annual premium: $2,364

Why it’s expensive: Florida’s high rate of uninsured drivers, combined with frequent natural disasters like hurricanes and floods, results in sky-high premiums. Additionally, the state’s urban density and high rates of fraud further contribute to the steep costs.

3. Louisiana

Average annual premium: $2,190

Why it’s expensive: Louisiana faces a unique blend of challenges, including high rates of accidents, frequent flooding, and expensive medical costs. Furthermore, the state’s legal environment, with frequent lawsuits related to car accidents, raises insurers’ expenses and premiums.

4. New York

Average annual premium: $2,044

Why it’s expensive: New York’s urban centers, like Manhattan, are notorious for traffic congestion and higher theft rates. Additionally, the state requires higher minimum liability coverage limits than most, which drives up premiums.

5. Nevada

Average annual premium: $1,934

Why it’s expensive: With a mix of population growth, rising demand for insurance, and extreme weather conditions like desert storms, Nevada rounds out the list of the most expensive car insurance states. Las Vegas, in particular, contributes significantly to the state’s high claims rate and premiums.

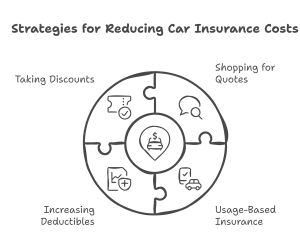

Strategies for Lowering Your Car Insurance Costs

Living in one of the most expensive car insurance states doesn’t mean you’re destined to overpay. By taking proactive measures, you can reduce your premiums without sacrificing adequate coverage.

For High-Cost States:

- Shop Around for Quotes: Each insurer uses different methods to calculate rates. By comparing multiple quotes, you may find one that offers significant savings.

- Consider Usage-Based Insurance: If you don’t drive often, usage-based insurance that charges by mileage could save you money.

- Increase Deductibles: Opting for a higher deductible can lower your premium, although this means you’ll pay more out of pocket in the event of a claim.

- Take Advantage of Discounts: Many insurers offer discounts for bundling policies, installing safety devices, or maintaining a clean driving record.

General Strategies:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations over time can lead to lower rates.

- Improve Your Credit Score: Some states allow insurers to factor in credit scores when setting premiums.

- Drive a Safe Vehicle: Cars with advanced safety features or lower repair costs often come with reduced insurance rates.

The Future of Car Insurance

The car insurance industry is poised for significant change in the coming years, thanks to technological advancements and evolving regulations. Here’s what the future might look like:

1. Telematics and Personalized Premiums

Many insurers are adopting telematics, where devices or apps monitor driving habits. Safer drivers can benefit from tailored premiums, incentivizing careful behavior on the roads.

2. Electric and Autonomous Vehicles

The rise of electric vehicles (EVs) and autonomous cars could change how insurers calculate risk. While repair costs for EVs are currently higher, widespread adoption may eventually drive costs down. Autonomous vehicles are expected to reduce accidents over time, potentially leading to lower premiums.

3. Climate Change Adaptation

With extreme weather events on the rise due to climate change, insurers may need to reassess how they factor environmental risk into premiums. Areas with frequent floods or hurricanes may face increasing rates.

4. AI-Driven Claims Processing

Artificial intelligence is streamlining insurance claims by assessing damages and processing payouts faster. This could help reduce costs and improve customer satisfaction.

Take Control of Your Car Insurance Costs

Navigating the landscape of car insurance, particularly in the most expensive states, can feel overwhelming. However, by understanding the factors driving your premium, researching options, and leveraging cost-saving strategies, you can take control of your expenses.

Whether you live in Michigan, Florida, or any other high-cost state, staying informed is key to making smart decisions about your car insurance. Take the first step today by exploring insurance options near you—compare quotes, evaluate your coverage, and start saving with confidence.