Fine wine collecting has long held a place of prestige and allure among enthusiasts, luxury collectors, and savvy investors. Beyond its cultural and sensory appeal, fine wine has become a unique asset class, commanding staggering prices at auctions and private sales. Some wine collections have broken world records, further solidifying wine’s place not only as a beverage but also as a symbol of status and investment potential.

This article explores the most expensive wine collections ever sold, the factors that make these wines valuable, and tips for those venturing into collecting. Whether you’re a seasoned collector, investor, or passionate oenophile, you’ll gain valuable insights into this fascinating world.

The Most Expensive Wine Collections Ever Sold

Table of Contents

Several wine collections and bottles have reached astronomical prices at auctions, setting milestones in the world of fine wine. Here are some of the most notable examples:

1. The Macallan Fine and Rare Collection – $1.9 Million

While technically whiskey and not wine, this iconic collection deserves honorable mention due to the precedent it set for auctioning rare spirits. Sold by Sotheby’s in London, the collection consisted of 60 bottles spanning multiple decades, representing the pinnacle of luxury and scarcity.

2. The Romanée-Conti 1945 Bottle – $558,000

A single bottle of Romanée-Conti from 1945 became the most expensive wine bottle sold at auction in 2018 at Sotheby’s in New York. Renowned for its extraordinary depth and rarity, this vintage was one of the final productions from Europe’s pre-phylloxera vines.

3. Billionaire’s Wine Collection – $15.6 Million

Auctioned in Hong Kong, this wine collection belonged to an anonymous billionaire. It featured over 1,000 bottles, primarily showcasing Château Lafite Rothschild—a name synonymous with luxury and craftsmanship.

4. Massandra’s Sherry de la Frontera 1775 – $43,500

This historic bottle from the Massandra winery in Crimea dates back to the 18th century. While its price doesn’t surpass other wines in this list, its age and impeccable provenance elevate its historical value.

5. Château Margaux 2009 (Balthazar) – $195,000

Limited in production, the Château Margaux 2009 Balthazar (a 12-liter bottle) was sold for nearly $200,000. Buyers not only secured an iconic wine but also an invitation to tour the Château Margaux estate.

Factors That Drive the Value of Expensive Wine Collections

To truly understand why these wines reach such extraordinary prices, it’s important to break down key factors that contribute to value:

1. Vintage

Vintage refers to the year the grapes were harvested. Exceptional vintages, often marked by ideal weather conditions, yield highly desirable wines. Examples include Bordeaux’s legendary 1982 vintage and Burgundy’s 1945.

2. Rarity

Limited production or scarcity increases wine value significantly. For instance, Romanée-Conti produces only 5,000 to 6,000 bottles annually, making its wines some of the rarest in the world.

3. Provenance

A wine’s provenance—its documented history and chain of custody—plays a critical role in establishing authenticity and ensuring proper storage conditions. Bottles directly sourced from wineries or well-documented cellars fetch higher prices.

4. Brand Reputation

The renown of the vineyard or winery also impacts value. Names such as Château Lafite Rothschild, Screaming Eagle, and Domaine de la Romanée-Conti have established themselves as benchmarks of excellence.

5. Storage and Condition

Proper storage in optimal conditions preserves the wine’s quality over time. Buyers are often willing to pay a premium for wines stored correctly in temperature-controlled environments since improper storage can ruin even the finest wines.

6. Historical or Cultural Significance

Some wines garner value due to their association with historical events or famous individuals. For example, bottles linked to Napoleon Bonaparte or sourced from ancient vineyards add layers of fascination for collectors.

Iconic Wines Every Collector Should Know

Romanée-Conti

Burgundy’s Romanée-Conti consistently dominates lists of high-value wines. With its velvety complexity and unrivaled heritage, this Pinot Noir is a crown jewel in any collection.

Château Lafite Rothschild

Known for its elegance and age-worthiness, Château Lafite Rothschild is a Bordeaux first growth wine that often achieves record-breaking results at auctions.

Screaming Eagle Cabernet Sauvignon

Hailing from Napa Valley, this cult wine is characterized by highly concentrated flavors and extremely limited production, making it one of America’s most sought-after wines.

Château d’Yquem

For lovers of dessert wine, Château d’Yquem from Sauternes offers unparalleled richness and longevity, with bottles capable of aging beyond 100 years.

Where to Buy Expensive Wine Collections

Premium bottles are usually sold through well-established channels, ensuring security and authenticity.

1. Wine Auctions

Prestigious wine auctions hosted by Sotheby’s, Christie’s, and Acker Merrall & Condit are prime locations for purchasing high-value collections. These events attract global collectors and investors seeking the finest wines.

2. Online Wine Platforms

Platforms like WineBid, Cult Wines, and Liv-ex offer access to valuable bottles with the convenience of online transactions.

3. Private Sales

Private brokers and wine merchants provide personalized services, sourcing wines tailored to the collector’s taste and portfolio.

Tips for New Collectors and Investors

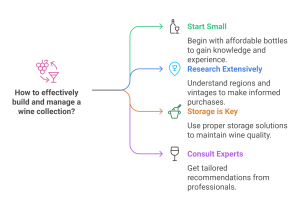

If you’re new to fine wine collecting, these tips will help you build a valuable collection:

The Most Expensive Wine Collections Ever Sold

- Start Small: Begin with bottles in the $50–$100 range to learn about different varieties and regions.

- Research Extensively: Understand key regions, winemaking practices, and vintages before making significant purchases.

- Storage is Key: Invest in proper storage solutions, like wine fridges or offsite cellaring services, to maintain your collection.

- Consult Experts: Enlist the help of wine consultants or sommeliers for tailored recommendations.

- Diversify Your Collection: Incorporate wines from multiple regions to balance risk and discover new favorites.

- Track Market Trends: Keep an eye on wine indices like the Liv-ex Fine Wine 100 to stay updated on market fluctuations.

What Lies Ahead for Fine Wine Collecting?

Fine wine collecting shows no signs of slowing down, with enthusiasts and investors eyeing emerging regions like South Africa and Argentina, in addition to traditional powerhouses like Bordeaux and Burgundy. Innovations such as blockchain technology are also being introduced for tracking provenance, ensuring authenticity in a growing market.

Whether it’s for personal enjoyment, investment, or both, wine offers a blend of cultural richness and financial opportunity that’s hard to surpass. With the right knowledge and strategy, anyone can participate in this elegant and rewarding pursuit.