Financial management is a challenge for many small business owners. In fact, studies show that about 60% of them struggle with bookkeeping and other financial tasks. This can lead to cash flow problems, missed growth opportunities, and a lot of stress. Fortunately, cloud accounting software has completely changed how small businesses manage their finances.

Xero is a leading cloud-based accounting solution designed specifically with small businesses in mind. It offers a powerful suite of tools that simplify complex financial tasks, provide real-time insights, and help you regain control over your books.

This guide will walk you through everything you need to know about Xero accounting software. We’ll cover its core features, the benefits it offers small businesses, its pricing plans, and how to get started. We’ll also see how it compares to popular alternatives, so you can decide if it’s the right fit for your company.

What Is Xero Accounting Software?

Table of Contents

Xero is a cloud-based accounting platform built for small and medium-sized businesses. Founded in New Zealand in 2006, it has grown into a global leader in the small business accounting space.

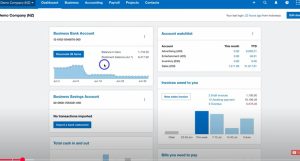

The main advantage of cloud accounting software like Xero is accessibility. Because your financial data is stored securely in the cloud, you can access it from any device with an internet connection—anytime, anywhere. This means no more being tied to a single desktop computer. You get real-time data, automatic software updates, and the flexibility to run your business on the go.

Core Features That Make Xero Stand Out

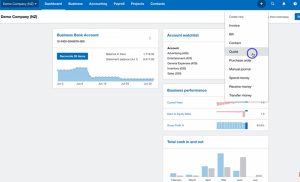

Xero is packed with features designed to streamline your financial workflows.

Invoice Management

Create professional, customized invoices in seconds. Xero allows you to automate recurring invoices, track payments in real-time, and send automatic reminders for overdue payments, helping you get paid faster.

Bank Reconciliation

Connect your bank accounts for automatic bank feeds. Xero imports your transactions daily, making reconciliation as simple as clicking “OK” to match them. This feature drastically reduces manual data entry and keeps your books accurate.

Financial Reporting

Get a clear picture of your business’s financial health with customizable, real-time reports. Generate profit and loss statements, balance sheets, and cash flow reports with just a few clicks to make informed, data-driven decisions.

Inventory Management

If you sell products, Xero’s inventory management feature is a lifesaver. It allows you to track stock levels, see your best-selling items, and calculate the value of your inventory, all within your accounting software.

Multi-currency Support

For businesses operating globally, Xero offers robust multi-currency support. You can send invoices, receive payments, and view reports in over 160 currencies, with exchange rates updated automatically.

Why Small Businesses Love Xero

There’s a reason millions of small businesses trust Xero. It’s built to solve their most pressing financial challenges.

- Time-saving automation: Xero can reduce manual bookkeeping tasks by up to 70%. By automating invoicing, bank reconciliation, and reporting it frees up your time to focus on growing your business.

- Real-time financial insights: With up-to-date data at your fingertips, you can monitor cash flow, track profitability, and make strategic decisions with confidence.

- Scalability: Xero grows with you. Whether you’re a solo entrepreneur just starting or an established company with a growing team, Xero’s flexible plans and features can adapt to your needs.

- Compliance made easy: Tax time becomes less stressful with automated tax calculations and reporting features that help you stay compliant with local regulations.

- Collaboration: Invite your accountant, bookkeeper, and team members to access your accounts simultaneously. You can set user permissions to control who sees what, making collaboration secure and efficient.

“Xero has been a game-changer for our small business. The automated bank feeds and easy reconciliation save me hours every week. I can finally focus on what I love—serving our customers—instead of being buried in spreadsheets.” – Jane D., Owner of a Small Cafe

Xero Pricing and Plans Breakdown

Xero offers several subscription plans, ensuring there’s an option for every stage of business.

- Early Plan: Perfect for startups, sole traders, and freelancers. This plan includes basic features like sending a limited number of invoices and quotes and reconciling bank transactions.

- Growing Plan: This is Xero’s most popular plan, designed for growing small businesses. It offers unlimited invoices, quotes, and bank reconciliation, making it a comprehensive solution for most small companies.

- Established Plan: Tailored for larger small businesses, this plan includes all the features of the Growing plan, plus advanced tools like multi-currency support, project tracking, and expense claims.

Xero offers a 30-day free trial, allowing you to test the platform before committing. Be sure to check their website for any current promotions.

Getting Started with Xero: A Step-by-Step Guide

Setting up Xero is straightforward. Here’s a quick guide to get you up and running.

1. Set Up Your Account

Start by creating an account on the Xero website. You’ll need to provide basic information about your business. From there, you can import existing financial data from a previous system or start fresh.

2. Connect Your Bank Accounts

One of the first and most crucial steps is to connect your business bank accounts and credit cards. This enables the automatic bank feeds that are central to Xero’s time-saving power.

3. Customize Your Settings

Take a few moments to set up your chart of accounts and create an invoice template with your company logo and payment details. This personalizes the platform to your business.

4. Adopt Best Practices

To get the most out of Xero, set up automated bank rules to categorize recurring transactions. Make it a habit to reconcile your accounts regularly—daily or weekly is ideal. Don’t forget to download the Xero mobile app for managing your finances on the go.

Integration Capabilities: Connecting Your Business Tools

Xero’s power extends beyond accounting through its vast app marketplace, which features over 800 third-party integrations. This allows you to create a connected ecosystem of business tools.

Popular integrations for small businesses include:

- Payment Gateways: PayPal, Stripe

- eCommerce: Shopify

- CRM: HubSpot

By connecting your favorite tools, you can further streamline workflows. For example, integrating Shopify with Xero automatically syncs sales data, eliminating the need for manual entry.

xero accounting soft

Customer Support and Learning Resources

Xero provides extensive support to help you succeed.

- Support Options: Access support through live chat and email.

- Xero Central: This is a comprehensive online hub with free training courses, how-to guides, and certification programs.

- Community Forums: Connect with other Xero users for peer-to-peer support and advice.

- Partner Network: Find certified Xero advisors, accountants, and bookkeepers in your area for expert help.

Xero vs. The Competition: How It Stacks Up

How does Xero compare to other popular accounting software?

|

Feature |

Xero |

QuickBooks Online |

FreshBooks |

Wave |

|---|---|---|---|---|

|

Best For |

Overall Small Business |

US-based businesses |

Freelancers/Service-based |

Sole traders/Micro-businesses |

|

Pricing |

Starts at $15/mo |

Starts at $30/mo |

Starts at $19/mo |

Free |

|

Invoices |

Unlimited on most plans |

Unlimited on all plans |

Unlimited on most plans |

Unlimited |

|

Integrations |

800+ |

750+ |

100+ |

Limited |

|

Users |

Unlimited |

1-25 depending on plan |

1 per plan |

Unlimited collaborators |

- Xero vs. QuickBooks: Both are powerful tools. Xero is often praised for its user-friendly interface and unlimited users on all plans, while QuickBooks is a long-standing favorite in the US with deep accounting features.

- Xero vs. FreshBooks: FreshBooks excels at invoicing and is great for service-based businesses, but Xero offers more comprehensive accounting and inventory features.

- Xero vs. Wave: Wave is a strong free option for basic accounting and invoicing, but Xero provides the advanced features and scalability growing businesses need.

Transform Your Small Business Finances Today

Choosing the right accounting software is a critical decision for any small business. Xero offers a powerful, intuitive, and scalable solution that can save you time, provide valuable financial insights, and grow with your business. By simplifying your bookkeeping, you can focus on what truly matters: achieving your business goals.

Ready to see how Xero can transform your finances? Take advantage of the free 30-day trial and experience the difference for yourself.

For more small business financial tips, subscribe to our newsletter!