Luxury SUVs are the epitome of power, style, and performance. They make heads turn, exude sophistication, and even offer impeccable comfort for families and adventurers alike. But owning a high-end SUV comes with its own set of challenges, one of which is sky-high insurance premiums.

If you’re considering purchasing a luxury SUV—or you already drive one—you might have wondered what makes certain SUVs more expensive to insure than others. And more importantly, is there a way to keep those premiums in check?

Whether you’re a luxury car enthusiast, an insurance expert, or a proud owner, this post will uncover the factors driving up costs, the most expensive SUVs to insure, strategies to save, and insights into the future of insuring luxury vehicles.

Understanding the Factors Behind Luxury SUV Insurance Costs

Table of Contents

Why does insuring a luxury SUV cost significantly more than a regular vehicle? Several factors come into play when calculating insurance premiums, and most of them are tied to the premium nature of the vehicle itself.

1. High Vehicle Value

Luxury SUVs like the BMW X7 or Range Rover Autobiography come with a hefty price tag—often exceeding $100,000. The higher the value of the SUV, the more expensive it is to repair or replace it in case of an accident. This increased liability translates directly to higher insurance premiums.

2. Expensive Repairs and Spare Parts

Luxury SUVs are built with state-of-the-art technology, premium materials, and specialized engineering. Replacing a bumper or repairing a damaged sensor in a luxury SUV can cost significantly more compared to standard vehicles. Insurance companies factor this in when determining premiums.

3. Safety Ratings and Features

While most luxury SUVs are equipped with advanced safety features, lower safety ratings or insufficient crash data can drive up premiums. Insurance providers assess the likelihood of filing claims, and vehicles with poor or no crash test ratings are considered a higher risk.

4. Higher Theft Rates

Luxury SUVs are prime targets for thieves. Vehicles with a higher risk of theft—or specific models that are frequently targeted—attract higher insurance premiums, even when equipped with anti-theft devices.

5. Driver Profile and Usage

Finally, your driving history, age, location, and whether your SUV is frequently driven in congested areas all play a role in determining the premium.

The Most Expensive SUVs to Insure in 2024

Curious about which SUVs top the list for insurance costs? Based on recent data, here are the five most expensive SUVs to insure and why they rank so high.

1. Tesla Model X Plaid

- Annual Insurance Cost: ~$4,900

- Why It’s Expensive:

The Model X Plaid is packed with cutting-edge technology, including Tesla’s autopilot system and advanced battery packs. These features, while impressive, are costly to repair or replace. Additionally, as an all-electric SUV, the limited availability of specialized repair centers contributes to higher premiums.

2. Range Rover Autobiography

- Annual Insurance Cost: ~$4,800

- Why It’s Expensive:

Known for its luxury and off-road capability, the Range Rover Autobiography’s advanced features, premium interior materials, and strong performance push-up repair costs. Additionally, high rates of theft for Range Rovers factor into its insurance costs.

3. Porsche Cayenne Turbo GT

- Annual Insurance Cost: ~$4,700

- Why It’s Expensive:

Porsche’s Cayenne Turbo GT combines dramatic speed with premium luxury, making it a favorite among enthusiasts. However, its sport-focused features and high-performance engine significantly increase repair and replacement costs, leading to steep insurance rates.

4. BMW X7 M60i

- Annual Insurance Cost: ~$4,600

- Why It’s Expensive:

The BMW X7 M60i is an ultra-luxurious SUV with advanced tech integrations and a powerful V8 engine. Insurance providers take into account its high value and intricate engineering, driving premiums up.

5. Mercedes-AMG G 63

- Annual Insurance Cost: ~$4,500

- Why It’s Expensive:

The iconic G-Wagon is a design and performance masterpiece, equipped with cutting-edge safety features and customized finishes. Its popularity among celebrities also makes it a theft target, further increasing its insurance costs.

Strategies to Lower Your Luxury SUV Insurance Costs

While insuring luxury SUVs may come at a higher cost, there are ways to minimize premiums without compromising your vehicle choice. Here are practical tips:

1. Enhance Vehicle Security

Install advanced anti-theft systems, such as GPS trackers and immobilizers. These reduce the risk of theft and may qualify you for discounted premiums from your insurer.

2. Drive Safely

A clean driving record over time can qualify you for safe driver discounts. Avoid speeding tickets and other violations to keep premiums manageable.

3. Bundle Insurance Policies

If you have other insurance policies (home, life, or additional vehicles), bundle them with one provider. Many insurance companies offer multi-policy discounts.

4. Increase Your Deductible

Opting for a higher deductible can lower your monthly premium. However, be sure to choose a deductible amount you can comfortably pay out of pocket in case of an accident.

5. Shop Around

Don’t settle for the first quote you receive. Comparison shopping among insurers can help you find the best deal tailored to your needs.

6. Take Advantage of Technology

Some insurers offer discounts if you install telematics devices that monitor driving habits. Good braking and acceleration habits can earn you significant savings.

Emerging Trends and Future Predictions for SUV Insurance

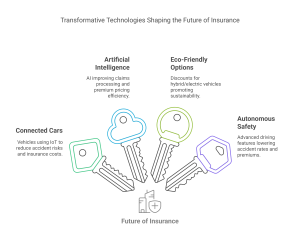

The landscape of SUV insurance is evolving rapidly, and several trends are reshaping the industry:

- Connected Cars: Vehicles equipped with IoT and connected technology are expected to reduce accident risks, potentially lowering insurance costs in the long run.

- Artificial Intelligence: AI-based claims processing could improve efficiency and speed, changing how insurers price premiums.

- Eco-Friendly Options: Insurance providers may offer discounts for hybrid or electric SUVs to promote sustainability.

- Autonomous Safety Advancements: Enhanced autonomous driving features may reduce accident rates, benefiting insurance premiums.

Make an Informed Decision for Your Luxury SUV

Whether you’re a long-time luxury SUV owner or eyeing your next big purchase, understanding the factors behind insurance costs is essential. By knowing which vehicles rank highest and implementing strategies to reduce premiums, you can make smarter financial decisions without compromising on the vehicle of your dreams.

Have experience insuring one of these luxury SUVs? Share your stories or strategies in the comments!

For those looking to explore related topics, check out our in-depth guide on luxury vehicles and hidden insurance fees. Knowledge is power, and an informed choice helps you stay ahead in the game.